"Lend Lease have informed the Council that no overage is forecast at the end of phase 1(Trafalgar Place)" Response to FOI request ref:570320

Southwark Council has been stunned to be told by Lend Lease that they will not be getting their expected share of the profits from the first completed phase of the Heygate redevelopment (now known as Trafalgar Place). The shock revelation is in response to a 35% Campaign FOI request.

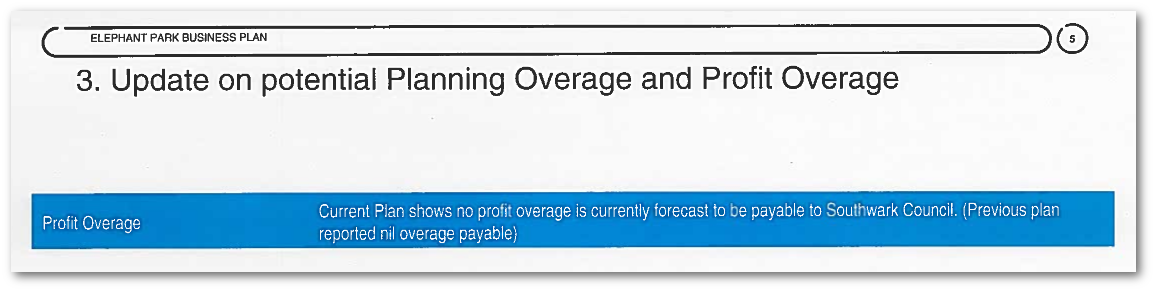

The revelation confirms doubts raised from a Previous FOI request we made for the annual audit of the development account, which said that no overage is currently forecast to be payable.

Southwark Council's response to our FOI request for the annual audit of the development account

Southwark Council's response to our FOI request for the annual audit of the development account

Southwark are entitled to 50% of the overage under a profit share agreement, detailed in the leaked Heygate regeneration agreement; the amount to be determined at the end of each development phase and paid upon the project's completion in 2025. Phase 1 (Trafalgar Place) has 235 new homes and was finished last June. Southwark were due to meet Lend Lease on 3 February 2016, but the meeting was cancelled - presumably because the Council would have left it empty handed.

Trafalgar Place - completed phase 1 of the Heygate redevelopment

Trafalgar Place - completed phase 1 of the Heygate redevelopment

This news will have come as a sore disappointment to Cllr Mark Williams, Cabinet member for Regeneration, who can be found 'setting the record straight' and telling us what the "true value of the Elephant & Castle regeneration" is:

"Some figures we have seen reported on websites and in the media are misleading and incorrect. The council receives phased payments as the scheme progresses and the figures are made public as we receive them. Further payment will be made as the land is drawn down, set to happen soon. The true receipts will amount to hundreds of millions."

It will also come as a disappointment to council leader Peter John who, in response to criticism of the Heygate deal claimed in December: "at the end of the day when profit is coming out of the site, the Council has a 50% share of the profits it delivers."

Council leader Peter John signing Heygate regeneration agreement with Lend Lease's Dan Labbad

Council leader Peter John signing Heygate regeneration agreement with Lend Lease's Dan Labbad

How can this be happening?

It could be that Trafalgar Place simply has not made enough profit to trigger an overage payment, but this would appear to be contradicted by Lend Lease Corporation reporting to the Australian stock exchange that its profits were up 12% to AUD $354m(£192m) in the 6 months to February 2016. Exactly how much of this profit is from Trafalgar Place we don't know, although Lend Lease does acknowledge that the profits are a result of "strong sales momentum at residential projects at Victoria Harbour in Melbourne and Elephant & Castle in London".

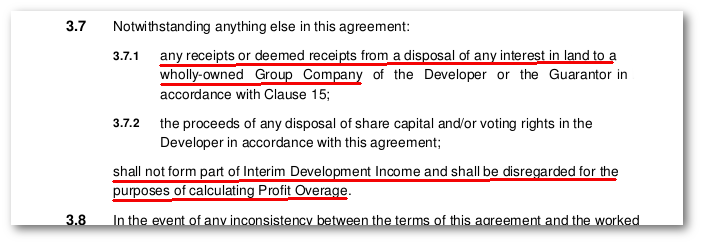

Alternatively, the explanation could lie in clause 3.7 of the regeneration agreement. This states that "receipts from a disposal of any interest in land to a wholly-owned group company .. shall be disregarded for the purposes of calculating profit overage".

Clause 3.7 of the regeneration agreement.

Clause 3.7 of the regeneration agreement.

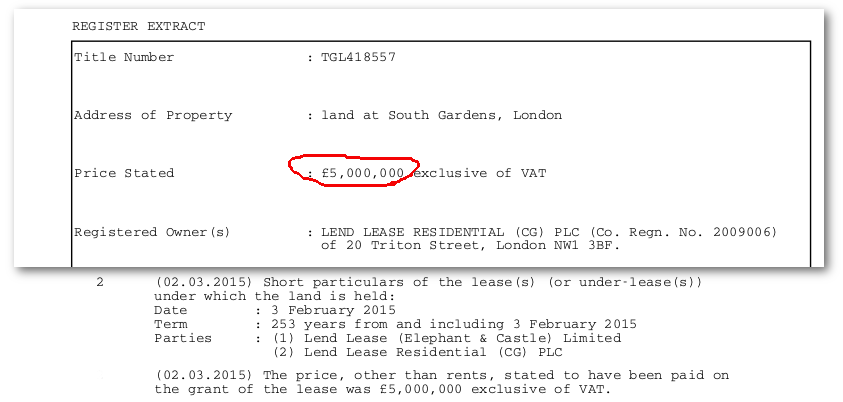

Lend Lease has unsurprisingly set up precisely this kind of group company arrangement; the parent company is Lend Lease Corporation, while Lend Lease (Elephant & Castle) Ltd is the contractual party to the regeneration agreement. It purchased the Heygate land for £50m and now sells the individual phases on to Lend Lease Residential companies. The land for Trafalgar Place was sold for £8m to Lend Lease Residential (BH) Ltd . Another plot, for Elephant Park (South Gardens), was sold to Lend Lease Residential (CG) PLC for £5m. The Land Registry deeds show the Lend Lease Residential companies selling their apartments to the final owners and we can presume that these companies hold the sales receipts, at least in the first instance.

Land Registry deeds for South Gardens

Land Registry deeds for South Gardens

The group company arrangements described in clause 3.7 are common; the advantage is that assets, such as land, can be traded between group companies, conveniently arranging debts and credits to put any profit out of the reach of third parties, who might otherwise have a claim to it; in this case however it doesn't look as if this was necessary - Southwark gave Lend Lease an easier way out.

Advised by experts

It's hard to believe that Southwark would not have anticipated the consequences for their overage of clause 3.7, or had not been warned by their professional advisors on the Regeneration Agreement about this possibility.

Press release originally published on Herbert Smith Freehills' website.

Press release originally published on Herbert Smith Freehills' website.

However it is equally hard to believe that the Council sought its professional advice from the same company (Herbert Smith Freehills), which back in Australia has a "longstanding relationship with Lend Lease and is the company's principal legal advisor".

Press release published on Herbert Smith Freehills' website.

Press release published on Herbert Smith Freehills' website.

Southwark demolished 1,212 council homes to allow Lend Lease to build well over 2,000 private homes on the Heygate, so we think that the public is entitled to the answers to some questions, three immediately coming to mind;

- How much profit have Lend Lease made on Trafalgar Place?

- In light of clause 3.7 will Southwark ever get any overage profit?

- What advice did Southwark get from Herbert Smith Freehills? The Council should respond to our FOI request and publish the advice immediately.

We leave the final words to the eminent architectural critic Rowan Moore, taken from the Heygate chapter of his recent book 'Slow Burn City' : “ Southwark Council has been played by developers. It has had its tummy tickled, arm twisted and arse kicked. It has got a poor deal in return for its considerable assets, multiple promises have been broken and violence done to the lives of many who lived there.”

We could not have put it better ourselves.