Council leader Peter John has claimed that Southwark Council will be getting "north of £100m" from the Heygate estate's redevelopment as 'Elephant Park'. He made the claim while being grilled by Steve Cananne of Australian national broadcaster ABC, in a report broadcast on Australian prime time television.

No profit for Southwark

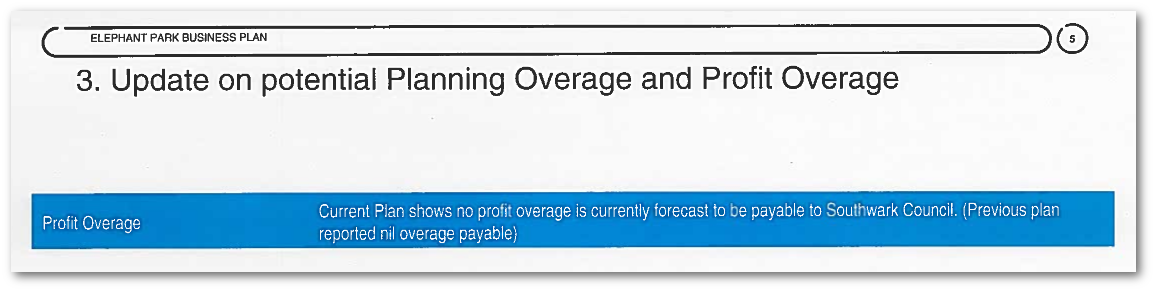

While claiming that Southwark will receive "north of £100m", Cllr John says he cannot say exactly how much this will be, until the development is complete in 2025. The 35% Campaign is glad to help Cllr John on this point. We have received the 2016 Elephant Park Business Plan in response to an FOI request and this baldly states that "no profit overage is currently forecast to be payable to Southwark Council", adding for good measure the "previous plan reported nil overage payable".

Extract from the business plan report received in response to our FOI request

Extract from the business plan report received in response to our FOI request

Southwark will continue to receive these reports every year, because of entirely sensible provisions in the contractual regeneration agreement with Lendlease, which says that the Annual Business Plan will be supplied to the Council and that it will contain "an update of potential Planning Overage and Profit Overage". (paragraph 13.2)

Cllr John also claims that profit would be shared in stages as the development proceeds. Not so, according to the regeneration agreement (see paragraphs 6.1.1 of schedule 5 and the bottom of page 83). Lendlease also removes any doubt that payment will not be until 2025, with its statement to ABC:

"We are currently three years into an estimated 12-year build programme and the overage calculation will be undertaken after the completion of the whole development, not after each phase."

Some further points to be noted about Southwark's overage profit share.

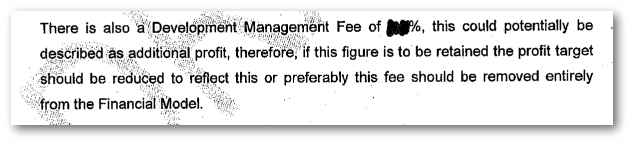

Southwark will be getting only 50% of the profit above Lendlease's ringfenced 20% "Priority Return" plus its 2.6% "Management Fee"[^1]. The management fee was criticised by the District Valuer's review of the viability assessment figures, which he described as 'additional profit'.

Extract from the DVS's review on the Heygate figures

Extract from the DVS's review on the Heygate figures

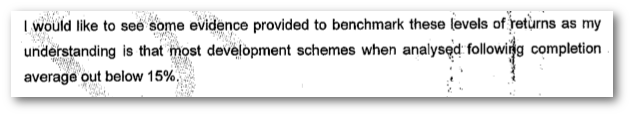

Cllr John claims that "20-25% is a normal profit margin for developments in London". However, again the District Valuer questioned this profit level and pointed out that most schemes at the time averaged below 15%:

Extract from the DVS's review on the Heygate figures

Extract from the DVS's review on the Heygate figures

Lendlease has a track record of accounting disputes with public authorities. In April 2012 it was fined $56m for overbilling on a major public works contract in New York and in December 2012 it was sued by city authorities over its calculation of overage on the Barangaroo regeneration scheme in Australia, a case the Sydney authority lost). In 2014 it was embroiled in a High Court battle with the Victoria Urban Development Authority in Northern Australia.

Southwark spends, Lendlease profits

While Southwark has spent £51.4m on the scheme to date, received £18m of the £50m land payment and lives in hope of more, the profits for Lendlease are rolling in.

For the six months up to Feb 2016, Lendlease has reported record profits of $354m (£192m). Lendlease said its strong performance was partly down to “strong sales momentum at residential projects at Victoria Harbour in Melbourne and Elephant & Castle in London”.

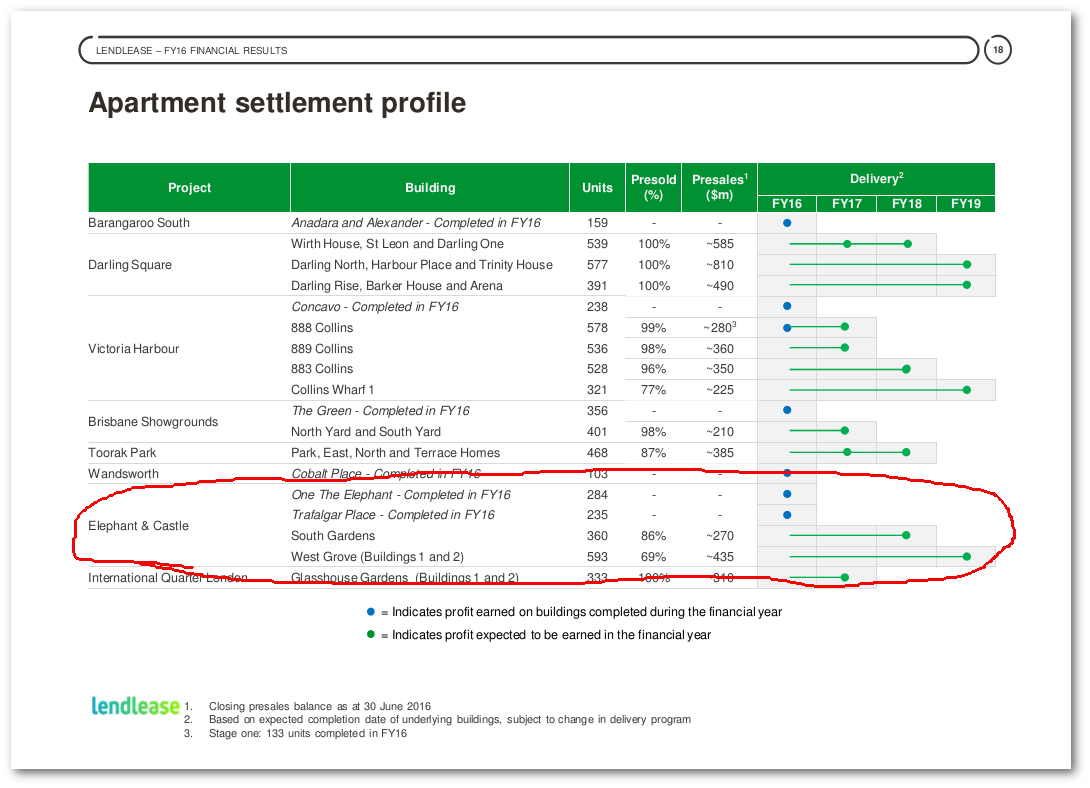

Its August 2016 financial report confirmed that the completed phase 1 of the Heygate (Trafalgar Place) turned a profit in 2016 and that phases two and three (South Gardens and West Grove) are also due to turn a profit in 2018/19.

Extract from Lendlease's financial report Aug 2016

Extract from Lendlease's financial report Aug 2016

The report also shows that Lendlease had presold 69% of its apartments in phase 3 (West Grove) off plan, netting it $435m (£260m) while construction had barely started.

Revolving doors

During the interview Cllr John was also asked about accepting Olympic tickets and a paid trip to a developers' jamboree in the South of France from Lendlease. He was also asked whether it was right for senior Council officers to go on to work for developers such as Lendlease. Councillor John failed to give a direct response, but mumbled something about perception not always being reality. Actually the reality is clear and we have published here details of the senior officers who have gone on to work for Lendlease.

Key documents still witheld

Cllr John claims a big commitment to transparency, but the Council continues to withold key figures and documents relating to the Heygate deal. Cllr John says that Southwark will be getting a share of the Elephant Park profits 'north of £100m', when all the available evidence is to the contrary.

If Cllr John knows something that we and the people of Southwark don't know, he should tell us. In particular, Southwark should publish a full unredacted copy of the most recent Annual Business Plan. This shows the inflows and outflows to the development and can tell us whether there will be any overage for the Council.

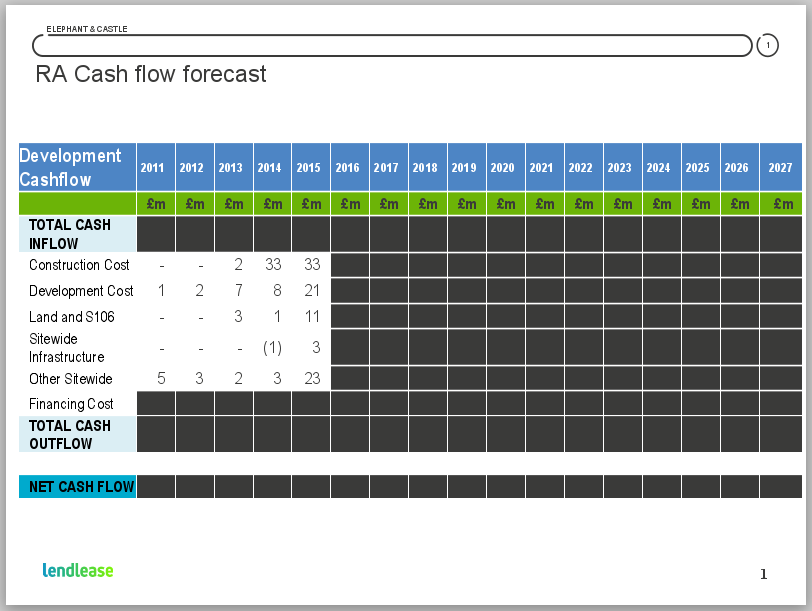

Redacted cash flow forecast showing the development account actuals

Redacted cash flow forecast showing the development account actuals

In addition, Southwark should publish:

The professional advice that the Council received from external consultants on signing the regeneration agreement.

The unpublished appendices of the regeneration agreement between Southwark and Lendlease.

A full undredacted copy of the District Valuer's report.

Cllr John with Lendlease CEO Dan Labbad signing the regeneration agrement in July 2010

Cllr John with Lendlease CEO Dan Labbad signing the regeneration agrement in July 2010

Footnotes:

[^1]: See "Developer's Priority Return" and "Development Management Fee" on pg 83 of the leaked Regeneration Agreement.