The Southwark Law Centre (SLC) has written to Southwark Council, detailing the shortcomings of the relocation of the independent traders from the Elephant & Castle shopping centre, prior to its demolition on 31 July 2020. The letter is supported by Latin Elephant and Up the Elephant, which includes the 35% Campaign.

SLC's letter supplies Southwark with the details of a survey of traders about the relocation, conducted just before the Coronavirus lockdown. This 'snapshot' survey of ten traders shows that 4 had not been offered a relocation space and the remaining six were offered the spaces that were inadequate, mainly because they were too small, but also because they were in poor locations for attracting trade and had no space for storage or for displaying their goods.

The letter also criticises the traders' appointed business advisor, Tree Shepherd, for a lack of appropriate support, particularly during the lockdown. The relocation fund is described as not fit for purpose and the relocation database of limited value. It regrets that Southwark approved using CPO powers on Delancey's behalf without any increase to the Delancey relocation fund.

The letter also notes that work on completing Castle Square had stopped and asks how this will impact on the traders' relocation. This is one of the four relocation sites and due to open in June - but work has stopped as a result of the coronavirus crisis:

The letter acknowledges that Southwark is not able to control the wider economic circumstances, but nonetheless calls on them to give stronger and more effective support to the traders.

Loyalty not repaid

All the trader respondents to SLC survey come from black and ethnic minority backgrounds, the longest serving trader having been at the Elephant for 22 years, while the longest serving trader not offered relocation space has been there 15 years; all ten traders together clock up over 115 years at the shopping centre.

In their survey comments all the respondents say the same thing - that more money is needed, and more space, and if the space cannot be found then compensation should be offered.

Relocation applications rejected

The SLC survey is a relatively small, but its finding that 4 out of 10 traders have no place to go is mirrored by the much larger and earlier research of Latin Elephant/petit elephant. This has tracked the fate of nearly a hundred businesses, since December 2018 and estimated that only 40 would be relocated, a prediction that now appears to be confirmed by Southwark Council in its own assessment of the relocation process. This states that while there have been 64 applications for three of the four main relocation sites, only 36 have been successful, with 28 rejected[^1]. Southwark gives no explanation for this, or says anything about what exactly it expects these 28 businesses to do. The fourth site, Elephant Park, has had one successful application out of 5[^2].

Public support for development falls

Southwark prefers to emphasise the increasing confidence traders are said to have, that they will be able to at least remain trading, by reference to an Equality Impact Assessment (EIA). This is cited as evidence that the so-called mitigation measures are working, despite the 28 rejected relocation applications. The EIA also reveals the embarrassing fact that public support for the shopping centre redevelopment from 67% in 2016 to 42% today, mainly because of concern 'about what will happen to businesses currently in the shopping centre'. The proposed remedy is to continue the well-meaning, but now hardly appropriate 'Follow The Herd' publicity campaign.

Crisis response needed

As we reported in our last blogpost Southwark has approved a welcome £200,000 in support of traders, agreed before the Coronavirus lockdown. Separately, Southwark has also launched a Business Hardship Fund of £2m, aimed at all the borough's 10,000 microbusinesses.

But otherwise Southwark's latest report on the progress of the shopping centre redevelopment takes no account of the entirely new, desperate circumstances of the Coronavirus pandemic. This could be excused as it is dated 24 March, the first day of the lockdown, but was not considered until 7 April, two weeks after lockdown, without any amendment or addendum, that recognised the new trading situation.

The report also gives no figures for any amount of money actually paid out to traders, from any source.

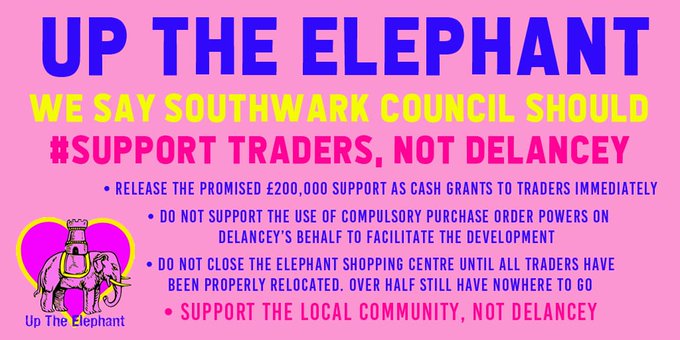

Support traders, not Delancey

Southwark has done Delancey the huge favour of adopting CPO powers and leasing both the shopping centre and the LCC, to override residents legal rights. While Southwark claim that is at nearly nil cost to itself, it will be of considerable financial benefit to Delancey, who would not otherwise have been able to secure the necessary funding for their redevelopment scheme[^3].

Southwark did this without insisting that Delancey improve its own support for traders. The relocation fund remains the meagre £634,700, agreed nearly 2 years ago, at planning committee. Delancey also still insist on closing the centre on the 31 July, with some minor concessions and despite the SE1 survey that showed 72% of local people want the centre kept open.

Over the past 3 years and more the shopping centre traders have been fighting a hugely unequal battle to keep their businesses going, while the centre has been rundown and trade blighted. Now is the time for Southwark to start giving the level of support it has been giving Delancey. It must get cash to traders for their immediate survival. It must tell Delancey it will not be using its CPO powers on its behalf, until all the traders are either relocated or suitably compensated and that there must be no centre closure until this is done.

You can support us in our fight for fairness for traders, by sharing these hashtags;

#supporttradersnotdelancey #supportelephantnotdelancey #ElephantJR.

Footnotes:

[^1]: See Elephant and Castle Shopping Centre Progress Report Appendix D para 23

[^2]: See Elephant and Castle Shopping Centre Progress Report Appendix D para 15

[^3]: See E&C Cpmpulsory Purchase Order Report para 16, 57