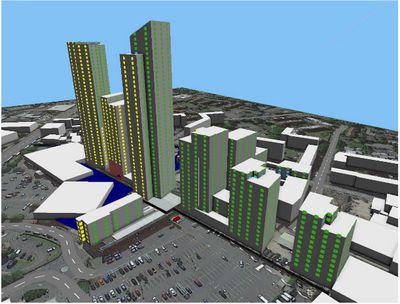

Berkeley Homes is the first developer in Southwark to threaten to reduce the affordable housing in one of its schemes, since the onset of the Coronavirus crisis. Berkeley secured planning permission for the Malt St development, just off the Old Kent Rd, in June 2019, with a promise to build 40% affordable housing. Since then it has joined-up with Peabody, who had a smaller, neighbouring development on Nyes Wharf. Together the two sites will provide 1,569 new homes, with 40% affordable housing (359 at social rent and 222 shared-ownership), delivered by Peabody.

Now a planning committee briefing reveals that this affordable housing is at 'risk' because Berkeley intends to mount an appeal that will reopen the question of the viability of the scheme. To prevent this happening, the briefing recommends approval of an unprecedented clause in Southwark's s106 planning agreement with Berkeley, that could see all the affordable housing lost, should development partner, [Peabody] hit financial trouble.

The Southwark Law Centre has written to the planning committee, objecting to the proposed clause and requesting a deferral, to allow the serious issues it raises to be properly addressed.

Why a Mortgagee in Possession (MIP) clause matters

The planning committee is being asked to approve a so-called Mortgagee in Possession (MIP) clause. Simply put, if a borrower cannot pay their mortgage, then the lender can take legal possession of the property and sell it - they become the 'mortgagee in possession' and up until now this has evidently been covered with a clause that keeps the affordable housing affordable 'in perpetuity' .

The MIP clause proposed for Malt St is different - it will not secure the affordable housing 'in perpetuity' , should Peabody fail. Instead, Southwark or another affordable housing provider would be given the option to take on the affordable housing, but if they do not, the affordable housing can then be sold onto the open market. If Southwark does buy the affordable housing, they would also have to pay anything outstanding 'under the terms of the relevant security documents, including all accrued principal monies, interest and costs and expenses' [^1].

The MIP briefing is at pains to point out that such a situation is very unlikely to arise, because Peabody is in rude financial health; it has an annual turnover of £630m, an annual profit of £160m and assets of £7.6bn, so the possibility that it will fail is remote. The briefing reinforces the point by noting that no major housing association has ever gone into administration and quotes a GLA document that says 'there is no known cases of a MIP clause being triggered.....' [^2].

Mayor of London opens the door...

This all begs an obvious question - why replace a MIP clause that protects affordable housing, in all circumstances, even unlikely ones, with a clause that does not?

Part of the answer is that this is what the Mayor of London wants. As Southwark's briefing explains it, the Mayor wants 'a consistent approach to MIP clauses across the London boroughs and to secure greater access to funding for RPs (registered providers) to increase the delivery of affordable housing'. The report continues; 'In order to achieve this, the GLA MIP clause would allow, in certain limited and unlikely circumstances, affordable housing to no longer be “in perpetuity”' . The briefing notes that Southwark's own MIP clause is different from the Mayor's, precisely on this point; Southwark does require affordable housing to remain such 'in perpetuity' , should a RP go into administration [^3].

Peabody takes advantage

Peabody also wants the GLA MIP adopted, because it would allow them to borrow more money for other projects. To quote the briefing 'Peabody have funds to deliver this scheme, but given the very large scale of the investment they are only willing to make such a commitment on the basis that they are able to secure additional funding in the future against the asset of the completed scheme' . The report says that while the Malt St scheme is 'entirely financed by Peabody from its own investment' Peabody nonetheless wants more private bank finance and needs to make more of its 'capital assets' and the banks consider that the affordable housing 'asset is not sufficiently liquid'. The briefing reiterates 'Peabody has confirmed that they cannot proceed as the RP [registered provider] partner in this scheme without this clause' [^4].

Berkeley turns the screw

Berkeley backs Peabody, saying that it cannot, or will not, proceed without them. Berkeley goes on to threaten to reduce the affordable housing in the scheme, if the GLA MIP clause is not agreed, by way of an appeal to the government of 'non-determination'. Berkeley would argue that Southwark had failed to conclude the s106 legal agreement in the required time, and also reopen the question of the viability of the scheme [^5]. Berkeley has a track record for such manouvers; this 2018 Guardian report shows that Berkeley has reduced its affordable housing obligations using viability reviews in almost all of its London schemes.

Southwark's briefing tries to make the best of things; as well as emphasising the unlikelihood of any default, it claims that this decision will 'not therefore set a precedent for other schemes.' The Mayor has different ideas - he wants to see his MIP clauses used across London and says they will be used for anything he 'calls-in', (such as the Biscuit Factory) and that he 'will promote their use for other schemes that are referable...and non-referable' ie basically everything [^6].

What we think

A Mortgagee in Possession (MIP) s106 clause that has evidently been perfectly adequate up to now is to be changed, compromising the 'in perpetuity' principle of affordable housing. The Mayor hopes that this will help meet his strategic 50% affordable housing target, but Peabody and Berkeley are not proposing 50% for the Malt St site. More generally, the Mayor has published no concrete commitment from developers and registered providers to increase affordable housing, in exchange for the Mayor's more market-friendly MIP.

So, while it would be easy for Southwark's planning committee to approve the clause in the almost sure knowledge that it will never be triggered and the affordable housing will remain as such, 'in perpetuity' , they should nonetheless reject the Mayor's new MIP clause. It purports to facilitate a general increase in affordable housing, but there is no evidence before the committee that this will actually happen, either in Southwark or elsewhere. On the other hand, though, the Mayor's MIP will definitely weaken the 'in perpetuity' status of affordable housing

This is the thin end of a very long wedge. These clauses have already been used in Islington, Tower Hamlets and Lambeth. They are being actively promoted by the GLA and the Mayor. Once they proliferate the whole principle of affordable housing being for 'in perpetuity' will start to be lost and developers and their registered provider partners will use the same kind of ingenuity that they have used with viability assessments to squeeze real affordable housing out of London [^7].

The briefing and its recommendation, will be considered by the planning committee meeting on Monday 4 May, the first to be held online.

Footnotes:

[^1]: MIP S106 Briefing-Malt St and Nyes Wharf paras 14,1

[^2]: MIP S106 Briefing-Malt St and Nyes Wharf paras 19, 17

[^3]: MIP S106 Briefing-Malt St and Nyes Wharf para 8, 14

[^4]: MIP S106 Briefing-Malt St and Nyes Wharf para 16, 15, 16, 9

[^5]: MIP S106 Briefing-Malt St and Nyes Wharf para 12

[^6]: MIP S106 Briefing-Malt St and Nyes Wharf para 23, GLA MIP s106 standard clauses, practice note Jan 2019 para 8

[^7]: MIP S106 Briefing-Malt St and Nyes Wharf para 24