In July 2007, Southwark Council valued its 25 acre Heygate site at £150m[^1]. The estate comprised 1,212 council homes of which 189 were owned by leaseholders.

The Council spent a total of £51.4m emptying the estate - and this figure doesn't include lost rental income or administration costs associated with progressing the scheme[^2]. The breakdown provided in this briefing report to is as follows:

| Cost | Amount |

|---|---|

| Decommissioning Costs | £8.315m |

| Cost of buyouts | £28.373m |

| Cost of new Crossway Church | £5.097m |

| Tenant relocation & homeloss | £5.779m |

| Council tax on voids | £1.819m |

| Temporary footway & Security | £0.419m |

| Demolition of Wingrave/RR site[^3] | £1.635m |

| Total | £51.437m |

The deal with Lendlease

Just 8 weeks after taking power from the Lib dems in 2010, Labour council leader Peter John signed an agreement to sell Lendlease the 25 acre Heygate site for £50m[^5] and 1.4 acres of the old leisure centre site for £6.5m - significantly less than other E&C development sites which have exchanged hands on the open market.

Cllr John signing the regeneration agrement with Lendlease's CEO in July 2010

Cllr John signing the regeneration agrement with Lendlease's CEO in July 2010

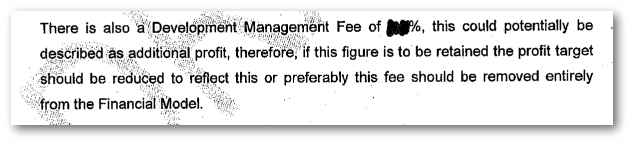

Councillor John argues that the Council will receive a share of the 'overage' profits from Lendlease. But the regeneration agreement and this Council briefing paper confirm that overage is only payable once the development is fully completed in 2025. Furthermore, the overage profit share arrangement only applies to profit surpluses over and above Lendlease's ringfenced 20% "Priority Return" plus a 2.6% "Management Fee"[^6], which was criticised by the District Valuer's review of the figures and described as 'additional profit'.

Extract from the DVS's review on the Heygate figures

Extract from the DVS's review on the Heygate figures

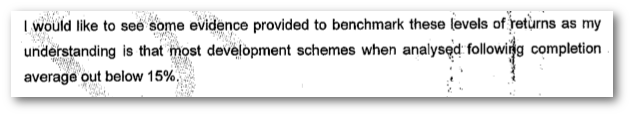

The District Valuer also questioned Lendlease's excessive profit level and pointed out that most schemes average out below 15%:

Extract from the DVS's review on the Heygate figures

Extract from the DVS's review on the Heygate figures

The amount of 'overage' payable (if any) is calculated by Lendlease, which has a track record for accounting disputes over such agreements; in April 2012 it was fined $56m for overbilling authorities on a major public works contract in New York; in Dec 2012 it was sued by city authorities over its calculation of overage on a similar size regeneration scheme in Sydney (which the authorities lost); and in 2014 it was embroiled in a High Court battle with authorities over the terms of a development contract in Northern Australia.

In Feb 2013, Southwark's Cabinet Member for Regeneration admitted in a local press article that "currently viability tests suggested there was unlikely to be any profit" from the Heygate deal. This was further backed up by the Council's Project Director in Jan 2014, when he confirmed the possibility of "the council receiving little or nothing from the profit-share provision in the Regeneration Agreement."[^7]

Southwark has argued that it will receive other contributions from Lendlease. But these are standard s106 obligations that all developers must deliver to mitigate the impact of a given development. This figure includes a £13m local transport levy payment towards the £160m cost of increasing capacity at the Northern Line tube station. The remainder consists mainly of benefits in kind: £24.9m is the 'estimated' value of the new 'public' park being built by Lendlease and £7.5m is the estimated value of new roads being built within the development.[^8] The roads and park are now privately owned by Lendlease and patrolled by their security team.

In an interview with Australian national broadcaster ABC, council leader peter John claimed that he thinks the Council will receive "north of £100m" from its profit share deal with Lendlease and that he understood that profits would be shared in stages as the development proceeds. In an interview with the local press, Southwark's Cabinet member for regeneration also claimed that the Council would get £100m in overage from the deal.

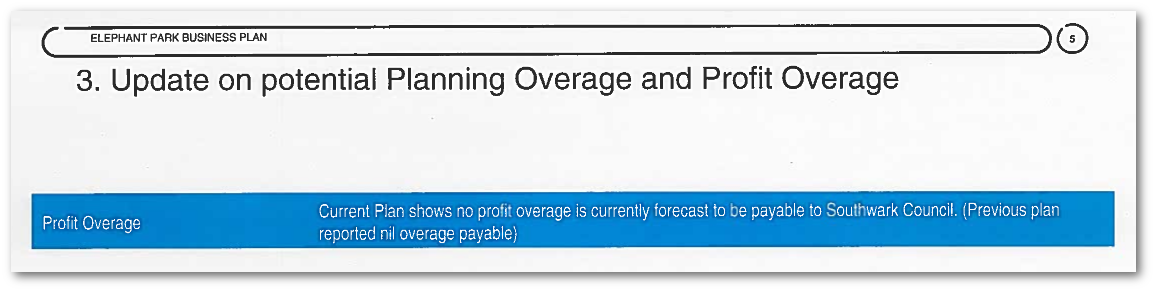

We have made regular FOI requests for the yearly audit report provided by Lendlease to the Council, which continually show that "no profit overage is currently forecast to be payable to Southwark Council".

Extract from the business plan report received in response to our FOI request

Extract from the business plan report received in response to our FOI request

Record profits

In the six months up to February 2016, Lendlease reported record profits of $354m(£192m), which it claims were partly down to “strong sales momentum at residential projects at Victoria Harbour in Melbourne and Elephant & Castle in London”.

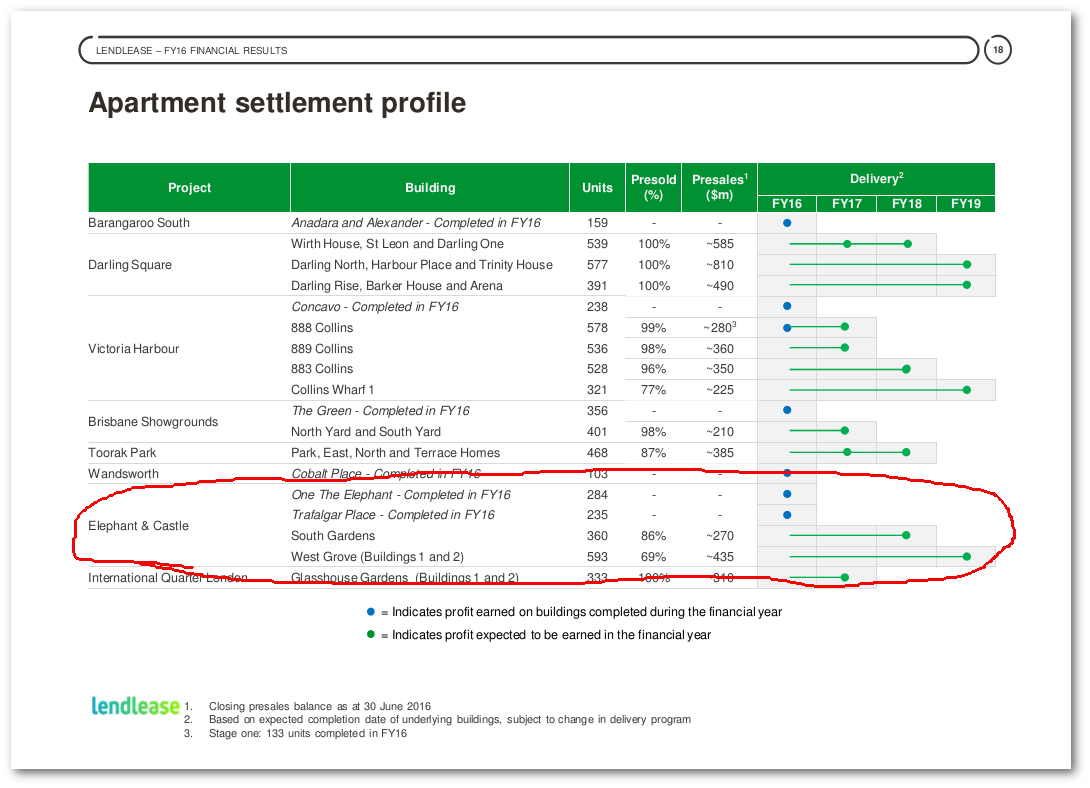

Its August 2016 financial report confirms that the completed phase 1 of the Heygate (Trafalgar Place) turned a profit in 2016 and that phases two and three (South Gardens and West Grove) are due to turn a profit in 2018/19.

Extract from Lendlease's financial report Aug 2016

Extract from Lendlease's financial report Aug 2016

The report also shows that Lendlease had presold 69% of its apartments in phase 3 (West Grove) off plan, netting it $435m (£260m) before construction had barely started.

The question of the Council's deal with Lendlease has been taken up on a BBC Politics show by local activist Peter Tatchell:

Council leader Peter John has also been grilled by Australian national broadcaster ABC, in an interview about the Heygate redevelopment. The following interview was part of the following report by ABC, which was broadcast on australian television:

Peter John has since stood down as council leader and been appointed Chairman of the Terrapin Group, a lobbying firm, whose client list is dominated by property developers including the Council's development partner for the Heygate estate (Lendlease) and shopping centre (Delancey).